- Homepage

- Our latest news

- How to finance your start-up?

How to finance your start-up?

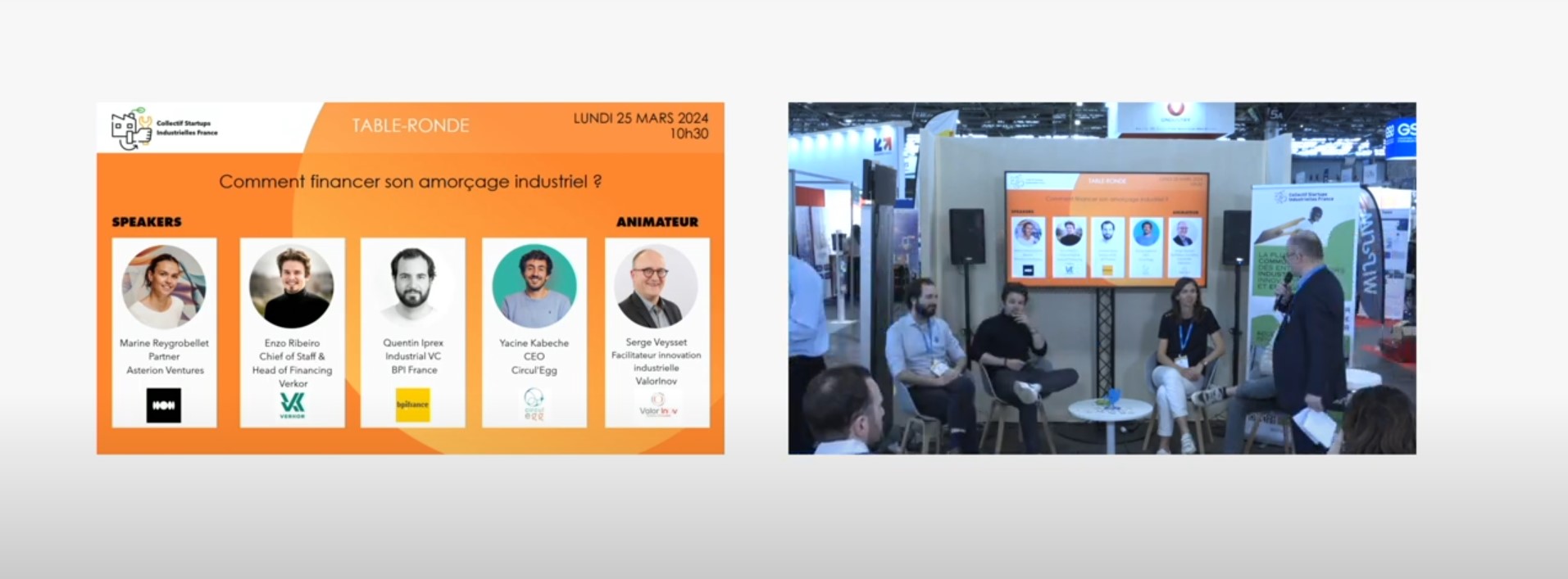

Marine Reygrobellet, Partner at Asterion Ventures, Yacine Kabeche, CEO of Circul'Egg, Enzo Ribeiro, Chief of Staff and Head of Financing at Verkor, and Quentin Iprex, Industrial VC at Bpifrance, enlightened the audience at this GI 2024 roundtable with a wealth of advice on industrial start-ups, particularly in the green industry. Eight commandments!

The round table featured a wealth of expert advice on the keys to success for industrial start-ups in terms of growth and financing. According to Yacine Kabeche, CEO of Circul'Egg, one of the first steps to success in industrial innovation is to fully understand customer needs. It's crucial to analyze the market in order to adapt one's offerings to meet specific expectations. This approach not only leads to the creation of relevant products, but also makes it easier to convince investors and business partners.

Surround yourself with experts and mentors

The importance of mentors was underlined by several speakers. Yacine Kabeche recommends surrounding yourself with experts who can provide strategic advice, whether paid or unpaid. These mentors play a key role, particularly during fund-raising, by contributing their experience and network to support the start-up in its decisions. Marine Reygrobellet, Partner at Asterion Ventures, adds that it is essential to choose partners based on their recent investments, in order to maximize synergies with investors.

Choosing the right type of investment fund

Every start-up is unique, and so are investment funds. According to Bpifrance's Quentin Iprex, it's crucial to select funds that are adapted to the company's specific strategy and needs. Marine Reygrobellet points out that the Asterion Ventures fund offers patient capital, with no liquidity pressures, enabling industrial start-ups to focus on developing disruptive technologies over the long term. Ensuring that the investor shares the same values and objectives is therefore a key success factor.

Validate commercial interest before industrialization

Quentin Iprex insists on the importance of validating the commercial interest of products before moving on to industrialization. Companies need to prove that they have potential customers by obtaining letters of intent, for example. This gives investors confidence and facilitates fund-raising. Enzo Ribeiro of Verkor agrees, explaining that the support of a first customer, like Renault in their case, is essential to finance the first critical stages, such as the pilot plant.

Raise funds gradually

Enzo Ribeiro from Verkor points out that the financial needs of an industrial start-up change at every stage of its development. It is therefore important to plan precisely the fund-raising required, whether for feasibility studies, the pilot plant or the construction of a gigafactory. This step-by-step planning makes it easier to manage risks and reassure investors by proving the viability of the project at every stage.

Relying on public aid and guarantees

Another valuable piece of advice is to take advantage of the public support available to industrial start-ups. Quentin Iprex points out that schemes such as the strategic project guarantee, which covers up to 80% of bank loans, considerably reduce the risk for banks and thus facilitate access to financing. These schemes, supported by the French government and the European Union, are important levers for companies in their growth phase.

Focus on recruiting and building a strong team

Recruitment is also a priority for start-ups in their growth phase. According to Yacine Kabeche, it's vital to build a team capable of adapting to the company's future needs. This includes not only technical skills, but also a thorough understanding of the market and commercial aspects. Enzo Ribeiro adds that involving the whole team in the allocation of shares helps to create a sense of ownership and long-term motivation.

Managing emotional fundraising fatigue

Marine Reygrobellet warns of the emotional fatigue associated with fund-raising, an often long and stressful process for entrepreneurs. It's important to prepare well for this stage by understanding investors' expectations and adjusting communication strategies. Good preparation helps you manage the pressure and avoid burnout.

Maintaining strategic consistency

Finally, Quentin Iprex stresses the importance of consistency in industrial projects. Every start-up has its own characteristics, and it's essential for entrepreneurs to know their market and their team inside out. A clear, coherent strategy, combined with real added value, is essential to attract the attention of customers and investors.